Blog | Federal Investment

March 6, 2025

May 6, 2024 | Awa Darboe

Join the CEBN for a webinar May 16 from 1-2 pm ET to learn more about the GGRF and other federal climate investments!

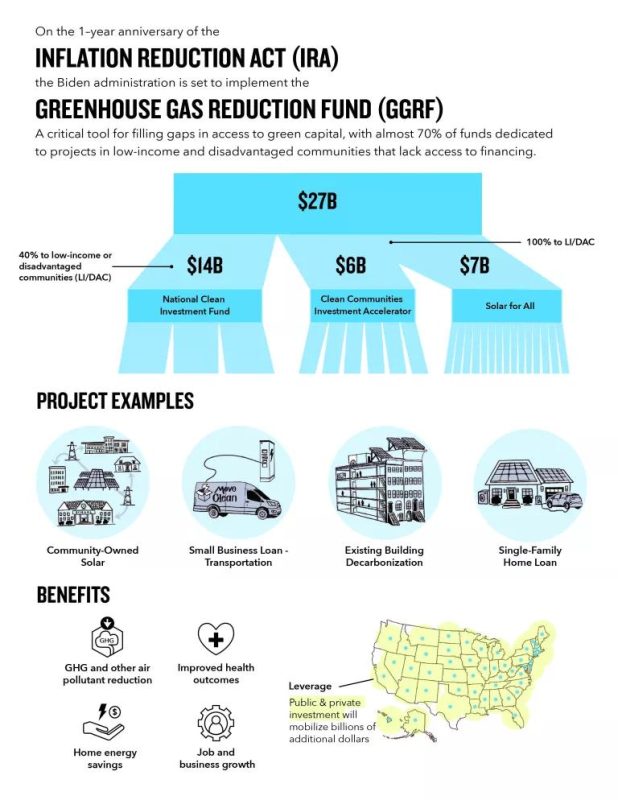

The Greenhouse Gas Reduction Fund (GGRF) was established under Section 134 of the Inflation Reduction Act (IRA) in 2022, allocating a total of $27 billion in funding towards the fight against climate change. The IRA authorized the Environmental Protection Agency (EPA) to create and implement the GGRF to mobilize financing and private capital for projects that reduce greenhouse gas emissions and air pollution in communities nationwide.

The GGRF comprises three key programs: the National Clean Investment Fund, the Clean Communities Investment Accelerator, and the Solar for All initiative. These programs aim to finance the deployment of clean technology on a national scale, especially in low-income and disadvantaged communities. They also seek to build the capacity of community lenders serving these communities and promote the adoption of clean distributed solar energy, which can reduce energy bills for millions of Americans. Additionally, these programs support the Justice40 Initiative and create new job opportunities in domestic industries with competitive wages.

Program Objectives

The GGRF aims to achieve the following objectives:

The $14 billion National Clean Investment Fund (NCIF) competitively selected three applicants to establish national clean financing institutions that will provide accessible and affordable financing for clean technology projects across the country. These organizations will collaborate with private-sector investors, developers, community organizations, and others to deploy projects, scale up private capital mobilization, and enable millions of Americans to benefit from reduced energy bills, cleaner air, and job creation.

All three selected applicants (listed below) intend to exceed the program requirement of allocating at least 40% of capital to low-income and disadvantaged communities (LIDAC). This commitment extends to historic energy communities, areas with environmental justice concerns, communities of color, rural communities, tribal communities, and more.

The $6 billion Clean Communities Investment Accelerator (CCIA) selected five applicants to establish hubs that will offer funding and technical assistance to community lenders operating in LIDAC. This approach provides an immediate pathway to deploy projects in those communities while also enhancing the capacity of hundreds of community lenders to finance projects for years to come.

Each selected applicant will provide capitalization funding (typically up to $10 million per community lender), technical assistance subawards (typically up to $1 million per community lender), and technical assistance services. These services will enable community lenders to provide financial assistance for deploying distributed energy, net-zero buildings, and zero-emissions transportation projects where they are most needed. 100% of the capital under the CCIA is dedicated to low-income and disadvantaged communities.

The five award recipients are:

Collectively, the impact of these organizations selected for CCIA and NCIF should reduce or avoid up to 40 million metric tons of carbon pollution annually over the next seven years. They are expected to mobilize nearly $7 of private capital for every $1 of federal funds. This approach ensures that each public dollar is leveraged for substantial private-sector investment. Additionally, they intend to allocate over $14 billion of capital—representing over 70% of the selections for awards announced—toward LIDAC.

Through the $7 billion Solar for All program, 60 awardees will establish new or expand existing low-income solar initiatives. These efforts will benefit over 900,000 households in LIDAC by providing access to distributed solar energy and will reduce 30 million metric tons of carbon dioxide equivalent emissions cumulatively. These Solar for All programs, collectively, will fulfill GGRF objectives by decreasing greenhouse gas emissions and other air pollutants. They will also bring electric bill savings to overburdened households and create new markets for distributed solar in 25 states and territories that previously lacked statewide low-income solar programs.

The selected applications consist of 49 state-level awards, six awards to Tribes, and five innovative multistate awards. All selected applicants intend to invest in local, clean energy workforce development programs to expand equitable pathways into family-sustaining jobs for the communities they are designed to serve. View the 60 selected applicants on this table.

By investing in innovative projects and empowering communities, GGRF’s $27 billion commitment is intended to drive meaningful progress for a sustainable and equitable future. EPA is supporting communities across the nation in taking meaningful action against climate change through catalyzing public and private capital for projects that reduce harmful climate pollution, improve air quality, and lower energy costs. The GGRF model will stretch public dollars further through public private partnerships and ensure that these investments are reaching low-income and disadvantaged communities through a targeted approach.

To stay up to date on the latest GGRF information, check out the EPA GGRF page, and for more information on what’s in the IRA, check out CEBN’s Insight into the Inflation Reduction Act blog series. We will continue to update and produce new content as more guidance becomes available!