Note: This blog post is intended for educational purposes only and should not be considered tax guidance. You may consider consulting tax counsel when navigating tax matters.

The Inflation Reduction Act (IRA), a historic climate law enacted in August 2022, provides numerous incentives for clean energy investment and production. These include expanded and new investment and production tax credits designed to drive deployment of clean energy. In addition to the base credit amounts, there are a number of bonus, or “add-on” credits to spur economic development in certain sectors or regions. One of these is the energy community bonus credit, which aims to incentivize investment in communities historically dependent on fossil energy jobs and tax revenues, promoting both economic growth and a just transition to clean energy. The bonus credit is designed to lower energy costs, combat climate change, and promote economic opportunity in communities that have relied on the energy sector for jobs.

The IRS has recently issued guidance on this bonus credit, which provides clarity on the eligibility requirements and credit amounts for taxpayers looking to qualify. Below is a summary of key points from the updated guidance to understand the latest developments.

Overview of the Energy Community Bonus Credit

The IRA provides increased credit amounts or rates for qualified facilities, energy projects, or energy storage technologies located in energy communities, which are defined as communities that are either on brownfield sites, coal communities, or metropolitan and non-metropolitan statistical areas with historic employment related to fossil fuels, each with its own qualifying criteria described in the following section. The Interagency Working Group on Coal & Power Plant Communities & Economic Revitalization provides an overview of technical assistance, funding, eligibility requirements and news and events regarding the bonus credit. The tax credits eligible for the energy community bonus are:

- Investment Tax Credit (ITC): IRA extended the 30% investment tax credit through at least 2032. Taxpayers are able to claim an additional 10% on this ITC through the energy community bonus credit as long as it satisfies prevailing wage and apprenticeship requirements.

- Production Tax Credit (PTC): Projects can increase their PTCs value by 10% if they are situated in an energy community (e.g., a project qualifying for PTCs of $27.50 per MWh would qualify an additional $2.75 per MWh).

Energy Community Categories

Brownfield Category

- Includes brownfield sites, which are defined in the CERCLA Act of 1980 as properties, the expansion, redevelopment, or reuse of which may be complicated by the presence or potential presence of a hazardous substance, pollutant, or contaminant. Essentially, these are sites that have been contaminated due to pollution from industrial use.

- Taxpayers can refer to federal, state, territory, or federally recognized Indian tribal brownfield resources or potential site lists to determine if a site meets the brownfield category requirements.

- Under the safe harbor provision, land can qualify as a brownfield site through the completion of environmental site assessments, confirming the presence of hazardous substances or pollutants/contaminants by federal, state, or tribal authorities.

Statistical Area Category

- The statistical area category applies to geographic areas that meet various statistical thresholds related to extraction activities at any time since 2009. This qualifying pathway applies to areas with 0.17% or greater direct employment related to fuel extraction, processing, or storage. An area can also qualify if at least 25% of local tax revenues were generated through these extraction activities.

- Additionally, an area qualifies for the bonus credit if an unemployment rate is at or above the national average for the previous year. Taxpayers can use the unemployment rates determined by the BLS Local Area Unemployment Statistics annual data for counties.

- The units of analysis for purposes of this category includes both Metropolitan Statistical Areas (MSAs) and Non-Metropolitan Statistical Areas. MSAs are defined as one or more counties that contain a city with a population of 50,000 or more or contains a Census-Bureau urbanized area and a population of 100,000 (75,000 in New England).

Coal Closure Category

While the statistical area category utilizes MSAs and Non-MSAs as the unit of analysis, the coal closure category uses census tracts. Qualifying energy communities include:

- Census tracts where a coal mine closed after December 31, 1999, or where a coal-fired electric generating unit was retired after December 31, 2009.

- Adjoining census tracts, which touch boundaries at any given point with a census tract with a coal closure (defined above).

Rules for Determining Location Requirement

- Qualified facilities must be “located in” an energy community (Sections 45 & 45y), while energy projects or energy storage technologies must be “placed in service” within an energy community (Sections 48 & 48e).

- For Sections 45 and 45Y, eligibility is made separately for each taxable year of the qualified facility’s 10-year credit period. Eligibility for the bonus rates under Section 48 and 48E are determined during the placed in-service date. If construction began on or after January 1, 2023 in an energy community, the location would continue to be treated as an energy community throughout the credit period or on the placed-in-service date.

- A qualified facility is considered located in an energy community if it is located there during any part of the taxable year.

- A project is considered as located in or placed in service in an energy community if 50% or more of the project’s nameplate capacity is located in an energy community. For projects that do not have a nameplate capacity, if 50% or more of its square footage is in an area that qualifies as an energy community, the project is located in or placed in service within an energy community.

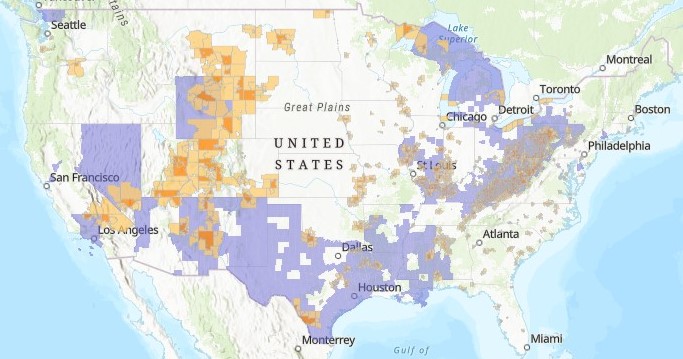

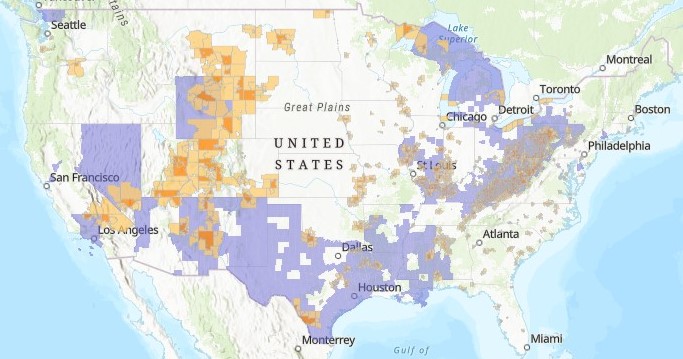

Energy Communities Location Map

The above map, created by the National Energy Technology Laboratory, includes geographical areas that qualify based on employment figures related to extraction. NETL hosts an interactive version of the map that enables users to identify areas by address or place. The dark orange parts represent Coal Closure Energy Communities. The light orange indicates areas adjoining a Coal Closure Energy Community. The lavender indicates MSAs/non-MSAs that meet both the Fossil Fuel Employment threshold and the unemployment rate requirements. (Brownfields are not included in the map.)

Rule for Beginning Construction

- The main difference between the updated guidance and the previous guidance released on April 4 is with respect to qualified dates. The guidance states that if a project or facility is within an energy community during the beginning of the construction date, the location will continue to be regarded as an energy community throughout the relevant determination date, which will allow the project/facility to access the bonus credit. However, with the updated guidance, this special rule is limited to projects/facilities that began construction following June 1, 2023.

Conclusion

The recent IRS guidance on the energy community bonus credit provides taxpayers with essential information on qualifying for increased credit amounts or rates. By promoting investment in energy communities and supporting the transition to clean energy, the bonus credit aims to stimulate economic growth and job creation. By leveraging these opportunities, taxpayers can maximize their benefits while contributing to a sustainable and inclusive energy future.

For more information on what’s in the Inflation Reduction Act, check out CEBN’s Frequently Asked Questions post. We will continue to update and produce new content as more guidance becomes available!

Additional Resources

Energy Community Tax Credit Bonus – FAQs – Energy Communities

Energy Community Guidance for Brownfields under the Inflation Reduction Act

Energy Community Bonus Credit Amounts under the IRA

New Treasury guidance on IRA domestic content rules

Treasury Quietly Changes Energy Community Guidance, Redefining Beginning of Construction Timing Rule | V&E Renewable Energy Update | Energy Transition | Inflation Reduction Act | Insights

U.S. Department of the Treasury, IRS Release Updated Guidance to Drive Additional Investment to Energy Communities